Merry Christmas and a Happy New Year!!!

2020. The MYGA is a basic, simple annuity, which provides the client with a guaranteed rate for the term of the contract. Whether it be a 3-, 5-, or 7-year product, the client understands they will receive the same rate for the term of the contract.

Because there are so many companies providing a variety of annuities, it can be difficult to determine which company to place a client’s trust and funds. The number one reason a client chooses one product/carrier over another is the rate, but the rate is not always the best variable to consider when buying. There are a number of reasons people buy a MYGA; one being the safety of the product. A MYGA is never going to go down in value (unless

make a withdrawal) and it provides that steady rate mentioned above. Another attractive reason for MYGA is tax deferral. The client doesn’t pay any taxes until they withdraw the funds. The annuity continues to grow tax-deferred throughout the years. Lastly, MYGA provides the option to make a penalty-free withdrawal. Although every carrier is slightly different regarding terms and conditions of a ‘penalty-free’ withdrawal, most allow the client to take out 10-15%, while others just allow the client withdraws of interest only.

When considering which annuity to provide a client, providing the client with additional information regarding allowable amounts to be withdrawn (penalty-free) if the annuitant would require nursing home assistance or has a terminal illness is another necessary

variable to consider? Or, what happens to the funds upon death? Does the beneficiary get the full or partial amounts?

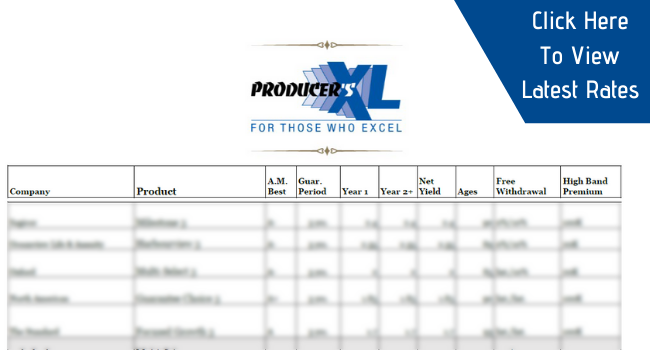

The strength and stability of the carrier also important in considering what annuity product to purchase. A carrier’s strength and stability can provide the reassurances to a client that a simple product alone cannot provide. Being able to provide a product with the backing of a strong, stable company name is what ProducersXL provides in all its products.

If you would like more information and/or have questions regarding any of the annuity products ProducersXL has to offer, please contact Scott Sandquist at Sandquist@ProducersXL.com.