Disability Toolbox

The Full Income Insurance Agent’s Kit

Disability InsuraNce Provides the Confidence of a Secure Income

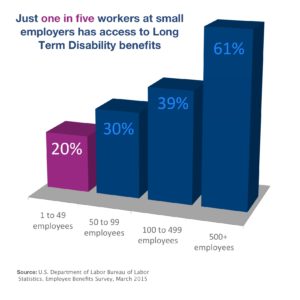

With disability income insurance, you can keep your clients financially healthy when life throws them a twist or turn. According to the Council for Disability Awareness, over 3.5 million working-age Americans have experienced a disabling event in 2019. With an aging workforce, it’s likely that we will trend towards an increase in the pool of individuals who need coverage. The U.S. Bureau of Labor Statistics, only 1 in 5 individuals working at small businesses have access to long-term disability coverage through their employer.

What is Disability Income Insurance?

This valuable coverage provides individuals with monthly benefit payments to help them pay for everyday living expenses in the event they become too sick or hurt to work. In the same way that car insurance covers a vehicle or homeowner’s insurance covers their house, disability insurance protects your paycheck. Anyone who values their income should also value protecting that income.

Sales ideas

Support

Disability Income

Kaela Scott

kaela@producersxl.com