Today I wanted to bring you a great way to visualize the advantages of the Pension Protection Act (PPA)

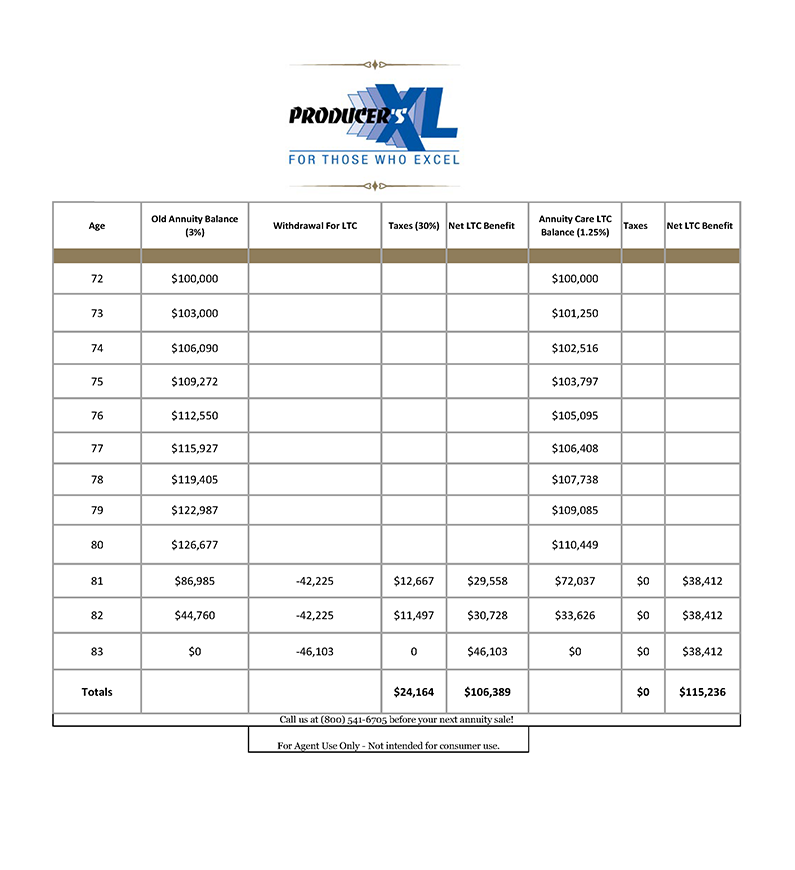

One of the advantages available to your clients under the Pension Protection Act is the ability to turn a non-qualified annuity into tax-free Long-Term Care benefits. We can visualize the differences between Traditional Annuities and a New Annuity Base with a simple hypothetical: Dan and Sara are both age 72 and have a Traditional Annuity that’s earning 3%. They have a $50,000 basis in the policy and, after eight years, one of them has a Long-Term Care event. As they start withdrawing funds from their Traditional Annuity, they end up paying taxes on their gain. If they spread their withdrawals out over three years they’ll end up receiving the

Angie Hughes

LTCi Marketing Manager

800.541.6705

net benefits that are shown below.

Contrast that with our Annuity Care Base Policy and you'll clearly see the benefits of a tax-free solution.

Dan and Sara would have to earn over 5% each year to net the same as the Annuity Care contract. My guess is that you have clients with these tax-deferred time bombs and are looking for options. Why not introduce them to a PPA annuity?

Use The Annuity Care Base Policy When:

- The clients are over age 70.

- The clients have a non-qualified annuity with significant gains.

- The clients have health concerns.