February 16th, 2021

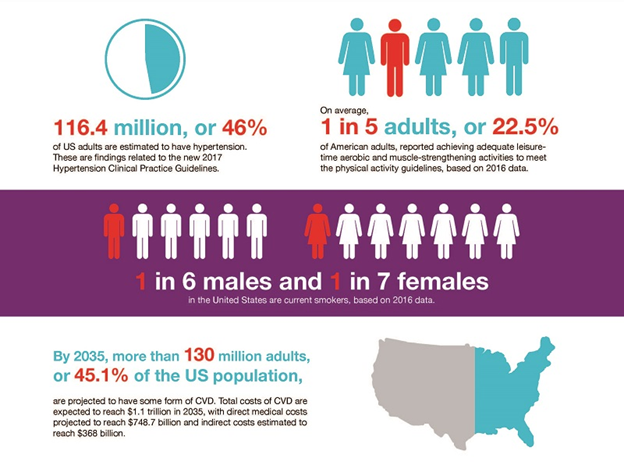

February is American Heart Month, a time when we put the spotlight on heart disease which is #1 killer in the U.S. During February, the American Heart Association and other organizations support the importance of heart health, including more research and efforts to ensure millions of Americans live longer and healthier lives. Heart disease is preventable for a lot of people when they practice a healthy lifestyle, which includes not smoking, maintaining a healthy weight, controlling blood sugar and cholesterol, treating high blood pressure, regular checkups, and at least 30 minutes of moderate-intensity physical activity a day.

Rick Roberts

Health Marketing Manager

800.541.6705

The COVID-19 pandemic has caused many people to delay or avoid going to hospitals for heart attacks and strokes. These actions are responsible for poorer outcomes. Also, while in lockdown, an increased number of people have engaged in unhealthy lifestyle behaviors, such as eating poorly, drinking more alcohol and limiting physical activity, all contributing to increased chances of heart disease.

"Cardiovascular diseases claim more lives each year than cancer and respiratory diseases combined? "

Did you know that cardiovascular diseases claim more lives each year than cancer and respiratory diseases combined? Heart complications can be scary and so can the unexpected costs as a result. With this in mind an agent needs to be aware there are insurance products that can help clients financially if they were to have a cardiac issue.

A Heart Attack & Stroke policy can help for this specific situation. We offer comprehensive Heart Attack & Stroke plans with great benefits to assist your customers to prepare for the unexpected. Everyone wants to live a happy, healthy life, but a heart attack or stroke can happen at any time. Having a heart attack or stroke can quickly cause financial problems. That’s why it pays to plan ahead.

What a base policy can offer:

› Flexible lump-sum benefits from $5,000 to $75,000 to use any way they like

› Cash payment can be paid directly to them or to anyone you choose

› Coverage for them, their spouse and/or their family

› Issue ages from 18–99

› Guaranteed renewable for life

› Not affected by any other insurance they may have

› Riders for added flexibility

(for an additional premium)

Their Money, Their Decision

Once they have received a lump-sum payment, they can use this money to pay for their out-of-pocket expenses, including medical costs that may not be covered by medical insurance, and living expenses.

› Deductibles/coinsurance

› Prescription drugs

› Rehabilitation

› Extended hospital stays

› Experimental therapy

› Mortgage payments

› Child care

› Ride shares

› Unexpected expenses

The costs associated with an unexpected heart attack, stroke, or other heart-related surgery can be overwhelming. A Heart Attack & Stroke policy can help your client spend less time worrying about money and more time working on your recovery.

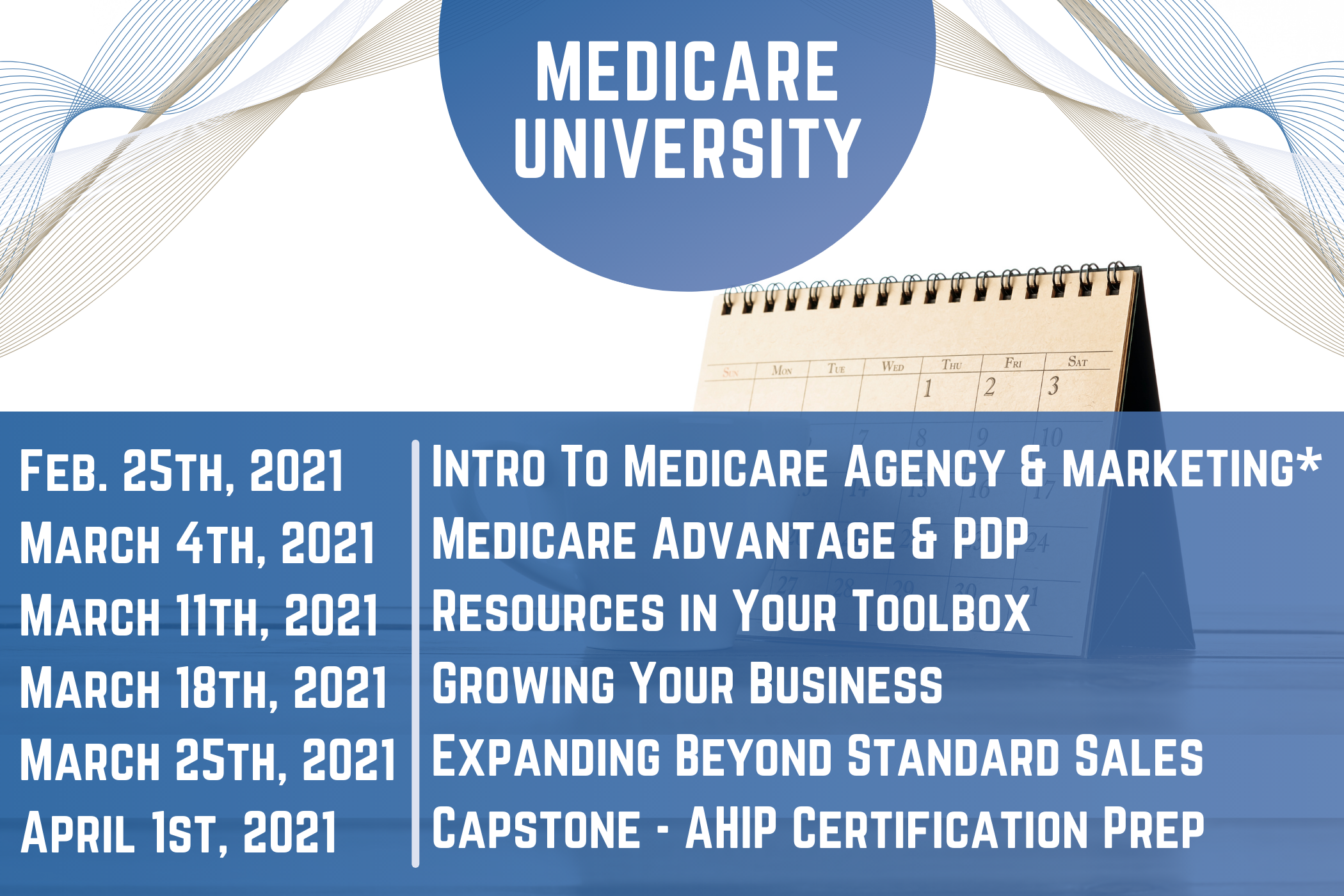

If you would like to learn more about the plans that we have available, please reach out to me and I would love to talk with you.

| For Professional Use Only