May 19th, 2020

Last month I introduced you to the new LASSO MSA Group Medicare Product and about how employers can reduce their overall group health care cost by providing an MSA benefit to its Medicare-eligible employees. I want to expand on this topic a little more this month.

Please be aware, all you need to market this product is a willingness to recognize this as a unique opportunity. It’s pretty easy to realize that these are trying times on the US economy and with this product can and will help employers substantially reduce their overhead. Today, you have an opportunity to potentially save someone’s job, maybe even someone’s company. Agents marketing this product today are on the ground floor and there is no other product like it in the US for senior group health benefits.

Sean McBride

Field Marketing

800.541.6705

You Don't Need a Background in Group Benefits

Getting started, you do not need a background in group benefits to be successful at marketing this product. We will provide you training on how to prospect for, approach, and present this product to employers. When putting this into practice you will find prospecting for a business owner is easier than prospecting for an individual. Not to mention, getting your foot in the door with one business can land you numerous new clients at once.

You Don't Need Medicare Experience

You do not need experience in Medicare to market this product. The product itself is very simple and easy to comprehend. Anyone with a health license can sell this product regardless of what your insurance background is.

You Don't Need To Be AHIP Certified

You do not need to be AHIP certified to market this product. Yes, it is a Medicare product, but because it is on a group chassis it does not require the AHIP certification. The company, Lasso Healthcare, requires a much-simplified certification that takes very little time and effort to complete.

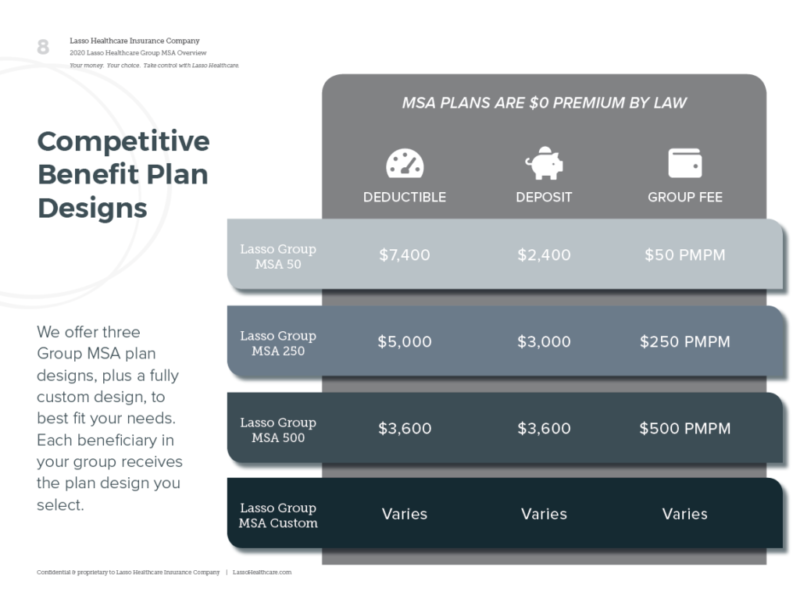

Some facts about the Lasso Group MSA for Medicare eligible employees

*No Networks – Nationwide coverage

*Zero Premium – Employee will never have one

*No Prescription Drug Plan Included-Employee can add own customized plan

*Annual MSA deposit – Unused funds remain with the employee

Available for sale in all 50 states

Minimum Group size is 2 / minimum lives covered 1

Enrollments can happen year-round

Does not require AHIP certification

* Per CMS, these benefits are part of the plan design and will never change.

Consider These Groups When Looking for Opportunity

Small Groups

This includes employer groups with no more than 19 full-time active employees who have at least one employee eligible for Medicare. About 75% of the business’s in the United States fall into this category. Small businesses are hurting the most right now, go out and talk to them. Be a hero.

Retiree Groups

Some employer organizations provide a health benefit to their retired employees. These Retiree Groups can be quite large and may include hundreds if not tens of thousands of members. When prospecting for Retiree groups, look for State Organizations, Unions, Associations, Municipalities, and large employers.

Professional Employee Organizations

Provide administrative services for employer groups. One PEO could provide these services, including accounting services, to hundreds of employer groups. EPO’s have a unique understanding of employer challenges. Cultivating a relationship with an EPO could open many doors.

What About Large Groups?

What about Large Groups, groups with more than 20 full-time active employees? As a result of new laws enacted on 01.01.2020 designed to expand the availability of Health Reimbursement Arrangements (HRA), we are dealing with a new set of rules and challenges for the LASSO MSA. Getting to the point, unless a Large Group has all active employees on an Individual Coverage Health Reimbursement Arrangement (ICHRA) it cannot be paired up with the MSA for the active age 65+ employees. If or when a Large Group adopts ICHRA for ALL active employees, we can begin to market the LASSO MSA to them.

We know Group Healthcare costs are on the rise and one of the reasons is the fastest-growing demographic within an employer group plan are the employees who are 65+. If the fastest growing demographic within an employer group is age 65+ and age-related risk is a leading contributor to higher premiums, what do you think will happen to future group healthcare costs?

I am doing a series of online meetings to talk more about this product and this opportunity. If you are intrigued enough to want to learn more, please join me on May 21st at 10 AM CST to get an introductory view of this product. Additionally, I will follow this meeting up with a more in-depth product review going over enrollment mechanisms, tax implications of MSA funds, and enhancing coverage with an HRA on May 26th, at 10 AM CST. You can register for all of our meetings on our Agent Events page and register for the applicable meeting or meetings you wish to attend.

As always, we appreciate you very much, and thank you for your loyalty and continued business. Have a great finish to May and remember to always be kind and make a difference.

Sean From the Field