Medicare Supplements: A Beginner’s Guide

Dipping your toes into the Medicare supplement sales arena doesn’t have to be intimidating; in fact, it can be your golden ticket to a booming career.

Whether you’re an insurance newbie or just looking to build on your current offerings, we’ve put together this great beginner’s guide on Medicare supplement insurance and the need for agents to offer their clients this valuable service.

Who Is This Beginner’s Guide For?

This guide is perfect if you want to learn more about Medicare Supplements, but it’s especially great for those already offering products and services relating to insurance and finances.

For example:

- Property & Casualty (P&C) Agents

- Auto Insurance Agents

- Certified Financial Planners (CFP®)

- Agents with a “niche” such as Final Expense

- Health Insurance Agents

If you already have a book of business, you’re primed for Medicare Supplement sales. People already want and need supplemental insurance, and they’re going to go somewhere to get it – they might as well get it from you.

Why Medicare Supplement Sales?

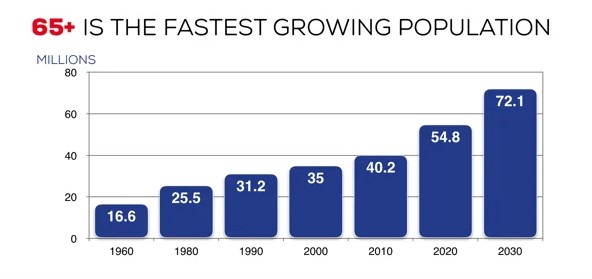

There are a ton of prospects in the Medicare market. Ten thousand seniors turn 65 every single day – that’s a lot of prospects that need Medicare Supplements.

When we look at a person that is going onto Medicare, it’s pretty confusing and overwhelming. Seniors get a ton of Medicare-related mail. It’s truly information overload.

It’s a serious sense of relief when that senior has someone that can explain how Medicare works.

These prospects are very overwhelmed when they’re trying to figure it out on their own, and you don’t have to come up with some slick sales pitch to get them to buy from you. You’re already a tremendous asset, and your help is truly wanted and appreciated.

A lot of prospects have retired from large companies that no longer pay for their post-65 health insurance. Many companies now offer a reimbursement so that the retirees can go out and buy their own insurance. It works great, but it leaves the retiree with a lot questions, and they need our help.

In sum, there are three great reasons to get into the Medicare Supplement market:

- There are lots of prospects

- Medicare is standardized

- There’s a built-in need for a secondary insurance with Medicare

What Are Medicare Supplements?

Medicare Supplements are insurance policies sold by private insurance companies. They’re meant to supplement Original Medicare coverage, because Medicare does not cover everything!

As an example, Medicare Part B generally covers about 80% of the bill – the remaining 20% could wreck a senior’s finances in an instant. A Medicare Supplement plan can cover that 20% in full.

Medicare Supplement plans are also called Medigap for this reason; they fill in the gaps left behind by Medicare.

A few quick things to know about Medicare Supplements:

- They don’t include drug coverage – a separate, Part D prescription drug plan is needed.

- Plans are lettered from A-N (Plan F, G, and N are the most popular options).

- Benefits for each plan letter are standardized by the federal government in most states, meaning you get the same exact benefits no matter which insurance company you buy from.

- In Massachusetts, Minnesota, and Wisconsin, standardized plans can be changed without federal approval.

A Word on Medicare Advantage

You should be aware there are two main routes a senior can take when it comes to their health insurance:

- Original Medicare with a Medicare Supplement and a Part D drug plan

- A Medicare Advantage plan

We’re not going to get into Medicare Advantage in this article, but you will want to consider both options when helping a senior with their insurance plan.

Medicare Supplement Plans A-N, Explained

There are currently 11 Medicare Supplement plans available:

- Plan A

- Plan B

- Plan C

- Plan D

- Plan F

- High-Deductible Plan F

- High-Deductible Plan F

- Plan G

- Plan K

- Plan L

- Plan M

- Plan N

I always find it the most interesting to find out which plans people are buying the most. What is the most popular?

I’ll narrow it down to the top 3:

- Plan F (for those who are eligible)

- Plan G

- Plan N

It’s much easier to narrow it down to a couple of plans so that you don’t have to understand the benefits of them all.

IMPORTANT: As of January 1, 2020, Plans C and F are no longer available to people who are new to Medicare. If you already have either of these 2 plans (or the high deductible version of Plan F) or are covered by one of these plans before January 1, 2020, you’ll be able to keep your plan. If you were eligible for Medicare before January 1, 2020, but not yet enrolled, you may be able to buy one of these plans.

Here’s a chart showing the coverage that comes with each plan (you can find this chart in the Medicare & You Handbook).